portland oregon sales tax on cars

This is the total of state county and city sales tax rates. As WA charges 2x sales tax on ALL vehicle rental activities and my clients.

1945 Morris Eight Series Car Advertising Morris British Motors

Password Please register to participate in our discussions with 2 million other members - its free and quick.

. The rate was reduced to 145 in 1993 when the City and County achieved code conformity and joint administration of the two separate programs. There are a total of 16 local tax jurisdictions across the state collecting an average local tax of NA. The state sales tax rate in Oregonis 0000There are no local taxes beyond the state rateOregon is one of 5 states that does not impose any sales tax on purchases made in the state the others being Alaska Delaware Montana and New HampshireThe cities and counties in Oregon do not impose any.

While many other states allow counties and other localities to collect a local option sales tax Oregon does not permit local sales taxes to be collected. The minimum combined 2022 sales tax rate for Portland Oregon is. Oregons zero percent vehicle sales tax makes it a great state in which to purchase a car but non-residents will be expected to register their vehicles and pay the appropriate tax in their home state.

When Sales Tax is Exempt in Oregon. Sales tax region name. Oregon vehicle dealers are allowed to pass the cost of the CAT on to consumers who purchase vehicles from them.

The cities and counties in Oregon do not impose any sales tax either. Avoiding Sales tax in Oregon Portland. Since there is a 0 state sales tax you dont need to calculate Oregon state sales taxFor instance if you purchase a new vehicle for 40000 then the state sales tax will be 0.

Search from 25296 Used cars for sale including a 2013 Subaru Crosstrek 20i Premium a 2014 Honda Accord EX and a 2015 Mercedes-Benz ML 350 4MATIC ranging in price from 995 to 699995. BEFORE YOU BUY. What is the tax rate in Portland Oregon.

187743 188129 189017 189261 189389 189794 189861 and 190129 effective October 16 2020 A. Portland Tourism Improvement District Sp. The new legislature will raise questions in terms of what is tax exempt.

Portlandgov 702500 Tax Rate. Although Oregon doesnt have a general sales tax the legislature enacted three taxes on wheeled forms of transportation in 2017. The tax established by the Business License Law is 22 percent of adjusted net income for tax years beginning on or before December 31 2017.

Over the years the tax rate has increased from 6 in 1976 to 146 in 1992. However Oregon does have a vehicle use tax that applies to new vehicles purchased outside of the state. The County sales tax rate is.

Research compare and save listings or contact sellers directly from 10000 vehicles in Portland OR. Click here for a larger sales tax map or here for a sales tax table. PORTLAND VANCOUVER KELSO.

Up to 7500 in Federal tax credits and up to 35 of the incremental cost between an internal combustion vehicle and an EV in Oregon Business Energy Tax Credits BETC. Oregon has no state sales tax and allows local governments to collect a local option sales tax of up to NA. City Code Section Amended by Ordinance Nos.

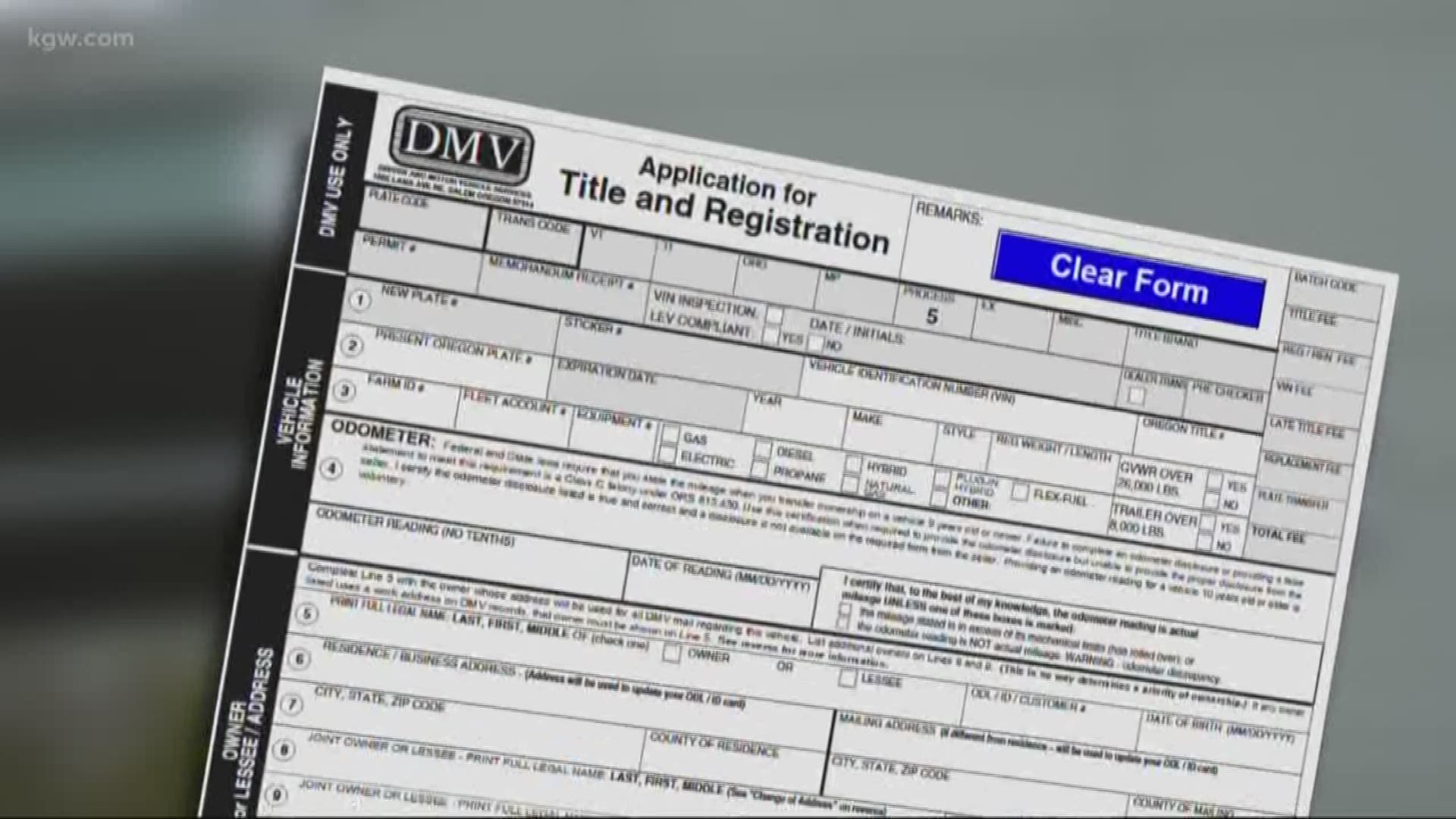

Transporting rental car insurance User Name. Set by the Oregon Department of Motor Vehicles DMV these depend on the type of vehicle you are purchasing. There is no sales tax on any vehicle purchased in Oregon.

Starting January 1st 2018 05 of 1 percent will be due on the retail price of any new taxable vehicles. As of January 1 2020 certain Oregon businesses will need to pay a new Corporate Activity Tax CAT. 1 2018 theres a tax on the privilege of selling new vehicles in Oregon a use tax for vehicles that were purchased in other states and a tax on the sale of bicycles.

Up to 2000 in Federal tax credits and up to 750 in Oregon Residential Energy Tax Credits RETC. Tax rates last updated in January 2022. The Portland sales tax rate is.

The Portland Oregon sales tax is NA the same as the Oregon state sales tax. How to Calculate Oregon Sales Tax on a Car. The vehicle use tax applies to Oregon residents and businesses that purchase vehicles outside of Oregon.

The state sales tax rate in Oregon is 0000. The Oregon sales tax rate is currently. Oregon residents will not have to pay sales tax on a vehicle bought in WA.

Sales tax About sales tax in Oregon Oregon doesnt have a general sales or usetransaction tax. There are no local taxes beyond the state rate. Test drive Used Cars at home in Portland OR.

Business Tax Credits - EV Purchase. All purchase orders subject to the tax. Oregon is one of 5 states that does not impose any sales tax on purchases made in the state the others being Alaska Delaware Montana and New Hampshire.

Some forums can only be seen by registered members. The tax must be paid before the vehicle can be titled and registered in Oregon.

/stories/2017/02/Oregontruck_3000.jpg)

Oregon S 1 000 Impact Tax On 20 Year Old Vehicles Spiked Soon Hemmings

Oregon Introduces Ev Rebates Bicycle Tax Electric Cars Oregon Car And Driver

How Tax Evasion Fuels Traffic Congestion In Portland City Observatory

Portland Or Travel Portland Photograph Aesthetic Roadtrip Vintage Vsco Road Trip City Aesthetic Oregon Waterfalls

Car Sellers In Oregon Getting Tickets Issued To New Owners Krem Com

2012 Mazda Mazda3 Mazda Mazda3 Mazda Mazda 3

Do Oregon Residents Pay A Sales Tax On Cars In Washington

Mad Max Interceptor At Oregon Gambler 500 2018 Travel Sales Interceptor Gambler